Human beings have always been far from perfect when it comes to decision making. It’s why we often fail to take care of our bodies, finances, etc., the best way we can. We also have internal biases and preconceived notions that cause us to make less than optimal decisions about our money. Unfortunately, these poor decisions can hold us back from reaching our goals and becoming our best selves. Today, we’re going to cover what mental accounting is, give you some mental accounting examples, and show you how to use it to your advantage to reach your goals.

What is Mental Accounting?

Mental accounting—a concept first introduced by American economist Richard Thaler, is often at the core of bad money decisions. These decisions can even affect our health. According to Psychology Today, mental accounting is when “people don’t treat all of their money (or time and effort) as if they have one big pool of it.” Instead, consumers keep separate mental accounts of different funds, then track it based on which account their spending came from.

The problem with mental accounting is that it doesn’t always work in the ways consumers intend it to. It’s especially true when it’s applied to financial resources. According to a 1996 report from The Journal of Consumer Research, applying mental accounting to budgeting leads you to consume too much of some goods while under-consuming others. The authors of the study, Chip Heath and Jack B. Soll, use these two examples to explain this in real-world terms.

“Mr. P had allocated money to his clothing budget to purchase slacks. After finding no acceptable slacks, he could have reallocated that money elsewhere; instead, he took home a sweater he ordinarily wouldn’t have purchased.”

“Ms. C had allocated too little money to her entertainment budget to cover her uncommonly rich entertainment opportunities. Instead of adding money from other accounts, she declined a dinner she would’ve enjoyed.”

When mental accounting is applied to finances, the authors argue that irrational decisions are often made. Unfortunately, these decisions can compound themselves, leading to disappointing financial performance and waste over the years.

Mental Accounting Examples Gone Awry

Mental accounting, or “mental budgeting” as it’s often called when referring to financial resources, is better than nothing. The alternative is spending money while making no effort to set limits, pay down debt, or save for the future. However, there are plenty of mental accounting examples that cause consumers to make decisions that don’t make any real-world sense.

Some mental accounting examples include:

Tax Refunds

Tax refunds are nothing more than the difference between how much you pay in taxes and how much you owed, Americans are famous for treating their refunds as “free money.” Retailers know this, which is why they roll out an onslaught of “tax refund sales” from the end of January until early May. Consumers could tweak their tax withholding to receive a bigger paycheck throughout the year and a smaller refund, but mental accounting leaves them looking forward to this windfall they can spend however they want.

Workplace Bonuses

Workplace bonuses are part of an employee’s compensation as their regular ongoing paychecks are. However, many people think of bonuses as “fun money” they can spend how they want, including for splurges. Bonuses are often spent on vacations, furniture, or other treats families may not be able to justify throughout the year.

Other Windfalls

Think of all the times you received money that wasn’t part of your normal income. Maybe you overpaid your property taxes and received a surprise check in the mail. Or perhaps you were given a financial gift you didn’t know about ahead of time. Psychology Today offers this mental accounting example of how it might apply to birthday money.

“For example, I gave my daughter money for her birthday. She was behind on her student loan. She should have definitely spent the money on that. But she was reluctant to do so. She perceived the birthday gift as “free” money.”

These are a few of the many mental accounting examples.

How to Use Mental Accounting to Your Advantage

Mental accounting occurs when you mentally divide your funds into separate accounts to cover different kinds of spending including bills, food, entertainment, and more. This doesn’t sound half bad. After all, learning to set spending limits is one of the best ways to avoid waste and reach financial goals. The problem with mental accounting is that many times, the decisions we make using mental accounting as a guide are hindered by our own internal biases and even poor spending habits.

However, this doesn’t mean you shouldn’t set limits on your spending or keep track of where your money goes. In fact, you absolutely should set spending limits and allocate your income in any given month.

Related: Using Mental Accounting to Motivate Savings

Start Using a Budget Each Month

The key is writing your internal money dialogue down on paper, and making sure your numbers make real-world sense. Don’t keep a mental list of spending categories and limits in your head where you’re likely to forget them. Instead, write your budget down (or use an app) to make sure your monthly accounting of all your expenditures (plus budgeted funds for savings and investments) are reasonable considering your income and goals.

Your monthly budget doesn’t have to be complicated or flush with detail, but it should include your anticipated income for the month in one column and your monthly estimated expenses in another. You should also make sure to include debt repayment, savings, and money you plan to invest as regular expenses, then pay yourself first before that money is accidentally spent elsewhere.

Here’s what a basic budget might look like:

| Monthly Income: | Monthly Spending: |

| $6,000 after taxes | Mortgage payment: $1,500 Car payment: $300 Car insurance: $100 Health insurance: $400 Gas and transportation: $400 Utility bills: $300 Savings account: $500 Credit card #1: $800 Credit card #2: $500 Groceries and dining out: $800 Entertainment: $200 Misc. spending: $400 |

Expect the Unexpected

The example budget above uses estimates for spending categories such as food, entertainment, and utility bills. However, err on the side of caution and make sure your spending estimates are reasonable to stay on track.

Also note how we set aside $400 in miscellaneous spending in this budget, which we believe is crucial for success. No matter how dedicated you are to the budgeting process, life happens and surprise expenses pop up. Set aside money for unexpected doctor’s visits, birthdays, and dinners you didn’t budget for but want to attend.

If you don’t budget for “extras,” you’re bound to let mental accounting knock you off track.

Stop Treating Windfalls as Free Money

One of the worst consequences of mental accounting is our tendency to treat windfalls as free money that doesn’t have the same power as the money we work hard to earn. That’s why we’re more willing to spend birthday money, tax refunds, bonuses from work, or an inheritance on an all-inclusive vacation to Barbados or a 60-inch flat-screen TV.

To make the most of our money, we need to learn how to save for what we want, then allocate any found money toward accounts we can use to reach our goals. A vacation to Barbados is definitely a worthy goal that can easily be budgeted for by setting aside a specific amount of money in your budget each month, and the same is true if you want a new flat-screen television. Mental accounting convinces us we can make purchases now, without consequences, because of a windfall that’s separate from our regular income.

In reality, the money we receive through a windfall has the same power to pay down debt or grow in a high-yield savings account like all other money in our possession. Mental accounting tells us found money is different, but it’s not.

Can Qube Help Me Stay On Track?

If you’re looking for ways to avoid the pitfalls of mental accounting, using a formal monthly budget can help. By putting your thoughts about how money should be spent down on paper, you can get a holistic look at your entire financial picture, including areas where it might be obvious you’re spending too much or not enough.

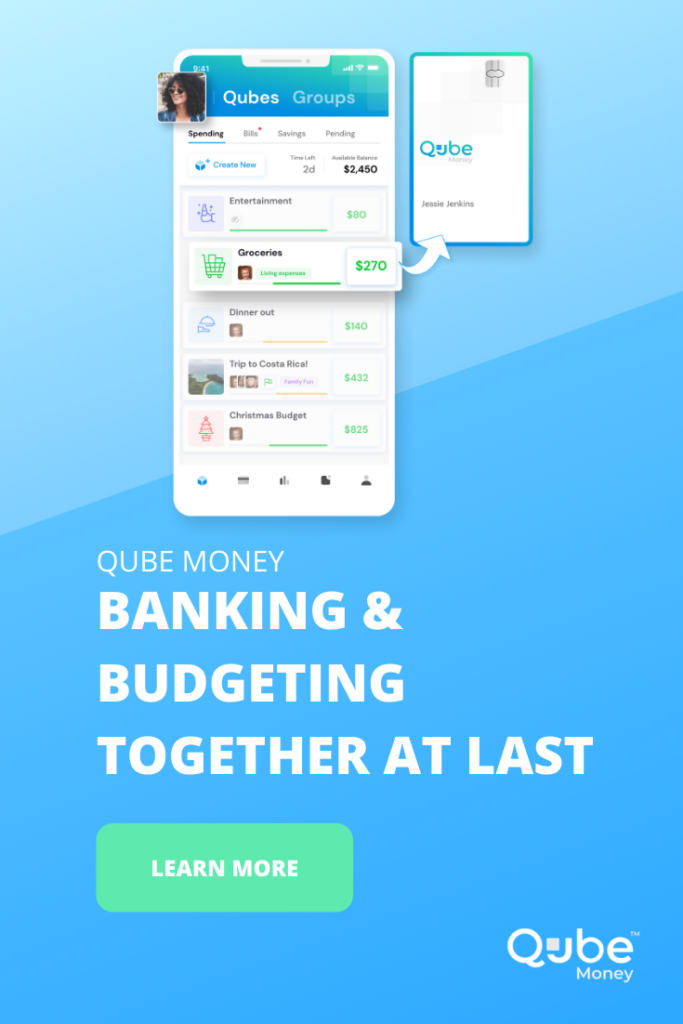

If you don’t like the idea of using a written monthly budget, you can also consider checking out Qube money — and even investing in a lifetime subscription. Qube Money helps you budget with digital cash envelopes called Qubes and a mobile app that lets you track your spending and stay on track with your mobile device.

The point of this app is helping you be more intentional about the money you work so hard to earn, and you even get to watch your progress in real-time. If you want to escape the pitfalls of mental accounting but know you need third party help, consider giving Qube a try.