If you’re like many other Americans, you despise talking to your partner about money, and you don’t know how to prepare for marriage. But, if you don’t communicate about your finances, you leave many financial variables unknown.

In fact, according to Experian, 25% of spouses don’t know their partner’s annual income and 40% are unaware of their partner’s credit score. ?

While this may not seem like it’s a big deal at the moment, it could cause conflict when you attempt to make a big financial decision.

For instance, let’s say you want to purchase a home but don’t know your partner’s credit score. If your partner has bad credit, it may harm your ability to obtain mortgage approval. Wouldn’t it be better to know this before you began to get excited about buying a home?

As challenging as it may be, having these tough money conversations before you get married can help you avoid financial heartache.

If you want to achieve a successful and long-lasting marriage, here’s how to prepare for marriage financially before you say your vows.

Related: 12 Questions to Ask Before Marriage About Money

Create Your Financial Goals and Objectives

Each partner has their own financial goals and objectives. These may be the purchase of a home, starting a family, or traveling around the world. Because you’re creating a lifelong partnership, you’ll want to create financial goals together.

As a couple, you can decide which goals you want to focus on and how you can support each other in achieving your joint and individual goals.

Take time to map out, in detail, what you envision for your future as a couple. Don’t limit yourself to a 5 or 10-year plan. Discuss your retirement aspirations and your preferred lifestyle.

Discussing your dreams will enable you to figure out where you and your partner share common goals and where you’ll need to compromise.

Read: How to Set Financial Goals in 2020

Take Inventory of Your Finances

Even if you think you may want to manage your finances separately, be as transparent as possible.

Taking inventory of your financial situations can help you get a better idea of your joint financial picture. You should make a list of all of your income, debt, retirement savings accounts, bank accounts, and other assets you’re bringing into the marriage.

You may also want to include your credit scores. This is especially true if you plan to apply for credit cards or a mortgage soon. If one partner’s credit isn’t up to par, this will give you time to work on it and make improvements before you apply for any forms of credit.

You may be embarrassed about your debt or credit score. Despite this, share your financial status with your partner. If you understand each other’s financial situation, you can create a debt repayment plan, a budget, and financial goals together.

Divide and Conquer Financial Responsibilities

Now that you understand your partner’s financial situation, it’s wise to divide and conquer your financial responsibilities.

You’ll want to determine how you and your partner will split the bills, retirement savings, and other expenses. If one spouse makes more than the other, they may have more financial responsibilities. On the other hand, if you both make about the same, you may decide to split all bills and expenses equally.

Before you decide who pays for what, make sure to have money conversations, so you’re on the same page. The more clarity you bring to your finances now, the easier it will be to make adjustments as you build a life together.

At this time, you may also want to determine if you’ll have a joint account, maintain your accounts separately, or do a bit of both.

Each decision comes with its own set of pros and cons. For example, if you choose to combine all of your accounts, and one spouse has a large amount of debt, the other spouse may become resentful if they have to help repay it. On the other hand, if you merge your accounts, it can help you better manage your debt as a team and repay it faster.

Related: How to Pay Off Debt as a Couple

Keep in mind, there’s no right way to manage your accounts. Each couple has their own financial needs requiring a different style of management.

Develop a Budget

Developing a well-thought-out budget is imperative to the success of your marriage. If you currently live with your partner, you may already have one.

If you’re moving in together once you’re married, you may need to create a budget ahead of time. Whatever your financial situation is, you’ll want to revisit or develop a budget.

Related: Budgeting 101: How to Create a Good Budget

You may want to start by creating a spreadsheet identifying your financial priorities. This should include your expenses and savings contributions. Once you have all of your fixed and variable expenses outlined, you can determine how much discretionary spending you have.

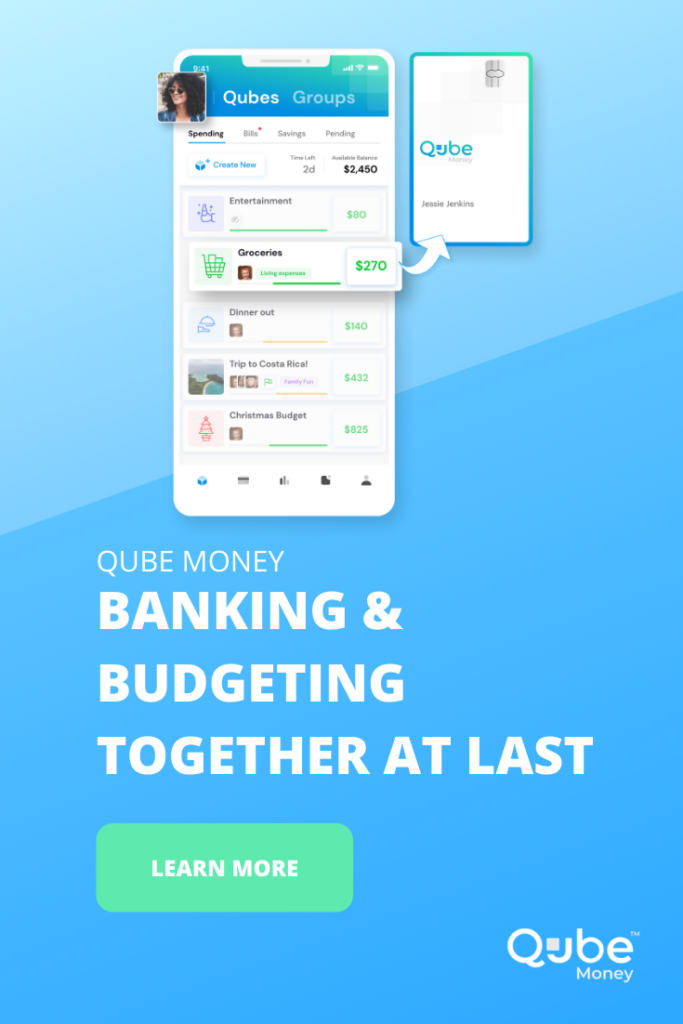

Once you have a budget in place, you may want to consider using certain tools and resources to help you stay on track. For example, using a budgeting tool like Qube can help you and your partner create positive spending habits and will help you stick to your budget.

Read: How Qube Money Helps Couples Budget Better

Even if one partner is going to manage your finances, both partners must have a good handle on your financial situation. Too often, one spouse will manage the finances, leaving the other spouse in the dark. While it may not be a day-to-day issue, it can cause concern if the spouse who manages the finances passes away.

Other reasons both partners should have a good handle on the finances include:

- Better financial decisions

- Progress toward financial goals

- Improves each partner’s financial confidence

While it’s okay for one partner to manage your assets, make sure both partners are in the loop. This will help with the success of your marriage.

Schedule Routine Check-Ups

Now that you and your spouse-to-be completed a financial inventory, created financial goals for the future, and developed a budget, you’ll want to schedule regular financial check-ups.

Taking the time to meet with your partner about your financial progress will help you prepare financially for marriage and celebrate your financial accomplishments.

Related: Budget Date Nights: Fun Financial Check Ups With Your Partner

Avoiding finances can veer your financial plan off course.

Reviewing your finances will help you stay motivated. It will also allow you to evaluate where you can clean up your habits, or even where you can loosen up.

Revise your financial plan to assure you’re still on track. Conducting check-ups will also allow you and your spouse to assure your goals and objectives remain the same.

If not, these conversations will enable you to initiate the discussion if they’ve changed and how you want to move forward. Ultimately, these check-ups will benefit your finances as well as your marital communication skills.

Assess Your Insurance Needs

Learning how to prepare for marriage financially takes time. And with all of the hustle and bustle of starting a new life together, it’s common for couples to forget about insurance options, such as life insurance.

Finding the proper insurance can help you avoid future financial devastation. For instance, life insurance is a crucial safety net for couples. This is because life insurance helps protect partners and children from the financial burden of death.

If you rely on your partner’s income, you must purchase a life insurance policy in the unfortunate circumstance of their passing. Start comparing policies and find the right life insurance plan to fit within your budget and financial needs. Even if you don’t rely on your partner’s income to support your lifestyle, you can select a life insurance policy that will assist you in paying for funeral expenses.

Before you get married, you may also want to review each partner’s health insurance plan. Even if your employer offers health insurance, your partner’s plan may make more sense for your health needs. Review each and determine which one will help you save money while getting the best care available.

Develop an Estate Plan

An estate plan determines where your assets will go and who will take care of your children once you’ve passed. If you forgo the estate planning process, you leave these decisions up to the state. Creating an estate plan will help ensure the fulfillment of your wishes upon your passing.

Create a trust or a will that defines your beneficiaries and where you want your assets to go. Keep in mind, this process may be time-consuming but worthwhile. Since every state has different estate laws, try partnering with an estate attorney for guidance.

At this time, you may also want to review all of the beneficiaries on your accounts. Updating your beneficiary information will help assure your assets will go to your partner in case of your death.

The Bottom Line

We get it, talking about your finances with your soon-to-be spouse can be challenging. But, these money conversations don’t have to be hard. The more open and honest you are now, the easier it will be to manage your finances as a couple in the future.

Transparency about your financial situation will help you and your spouse build a foundation of trust and honesty. It will also enable you to discuss your future aspirations as a couple, combining your goals into a lifelong action plan.

As the saying goes, “Two are better than one.” Create a partnership that emphasizes this value, and work as a team to achieve the lives you’ve always dreamed of, and learning how to prepare for marriage financially will be a concern of the past.