If you are reading this, then the chances are that you know you need to make a change to turn things around or at least get a nudge to help you reach your financial goals. Thankfully, this is precisely what Qube Money can do to help couples budget better.

“Too many people spend money they haven’t earned to buy things they don’t want to impress people they don’t like.” This famous quote by Will Rogers astutely describes the consumer-driven culture we live in today.

The truth is that saving money is harder today than any other time in modern history. Data shows that the cost of a college education has increased eight times faster than wages have over the past 30 years. Wages have also lagged behind skyrocketing healthcare costs and other expenses.

Combine this with social media (the Instagram effect) and the societal pressure to fit in, and we’ve created the perfect storm for overspending, under-saving, and not setting our lives up for financial success. Millions of couples are struggling to make sense of how to make ends meet and live the lives they always dreamed of living.

Related: How to Get Your Spouse on Board With Budgeting

Here’s how Qube Money helps couples budget better.

Qube Money Helps Couples Budget Better

Today, I’m going to walk you through what Qube Money is, how it’s perfect for a couple’s budget, and why it works. But first, let’s understand why budgeting is essential and how it has evolved!

Take a step back for a second and picture yourself in a state-of-the-art kitchen. A kitchen so beautiful Joanna Gaines could have designed it. You only have one task to complete in this kitchen: to chop an onion finely.

The cutting board is ready with a pristine onion sitting on top. There are two knives next to the mahogany board: One is a beautiful razor-sharp Japanese chef’s knife, and the other is a plastic butter knife.

Which one do you pick?

A budget is like a sharp knife ready to tackle the onion. A budget will help you save money, pay off debt, and invest for the future. Is it possible to reach your financial goals without a budget?

Sure!

Like it’s possible to dice an onion with a butter knife: it’ll likely take a lot longer, and it will surely be a lot more painful with a lot more crying involved.

Using a budget will mean more savings, less debt, more giving, and more investing!

The Evolution of Couples Budgeting Together

Budgeting for a single person can seem like a daunting task, but for a couple, it goes to a whole new level. You’re talking about several accounts, multiple sources of income, more financial complexity, and potentially kids.

Read: Budget Date Night: How to Have a Fun Financial Checkup

If you ask your grandparents or great-grandparents how they budgeted, they’ll probably say, “we didn’t budget; we lived within our means.” If you dig a little deeper, you’ll realize that they did budget; they didn’t even know it.

Before the days of credit cards, it was common practice to always carry cash everywhere. Those who wanted to make sure they didn’t live beyond their means would simply set some money aside, and once their spending cash ran out, they literally couldn’t spend again. They would repeat this when they got their next paycheck.

Before long, they had a nice amount of money saved up.

This system is so effective that some people still use it today. It’s called the ‘cash envelope method‘ of budgeting.

What is the Cash Envelope Method?

The cash envelope method is a tried and tested way of budgeting using cash.

The way it works is that you get several letter-sized envelopes, and you write your spending categories on them. Think of traditional budgeting categories like groceries, restaurants, utilities, clothing, gas, gym memberships, insurance, medical expenses, etc.

At the beginning of the month (or when you get paid), you’ll plan out how you will spend your money, and you’ll stuff the appropriate amount in each envelope.

Related: Why the Cash Envelope Budget Method Wins

Once the money runs out, there’s nothing left to spend — no credit cards to get you into trouble.

Cash works because it creates spending friction. This means it makes it harder to spend money impulsively since you’ll see the name of the category when you open the envelope. It also prevents you from going further into debt.

In many ways, it’s the most extreme form of budgeting and is extremely helpful for someone trying to break destructive financial habits.

Qube Money is the Modern Alternative to Cash Envelopes

Let’s face it; it’s impossible to thrive in modern society if you only use cash.

- No landlord or mortgage lender will accept a stack of money as payment

- You can’t pay your student loans or make your car payments in cash

- You can’t pay for a hospital stay in cash either.

Related: 11 Disadvantages of Cash

This means that everyone using the cash envelope method has to use a hybrid of cash and a debit card, which gets messy and confusing. It’s also not safe to walk around carrying cash everywhere. Using your debit card isn’t much safer since it can get stolen.

At the end of the day, if your budget system isn’t easy to use, then you aren’t going to use it. And a budget that isn’t adhered to 100% of the time is ineffective 100% of the time.

Qube Money is a couples budgeting app that removes the necessity of having to use cash while maintaining ALL of the benefits. Sounds nice, right?

How Does Qube Money Work

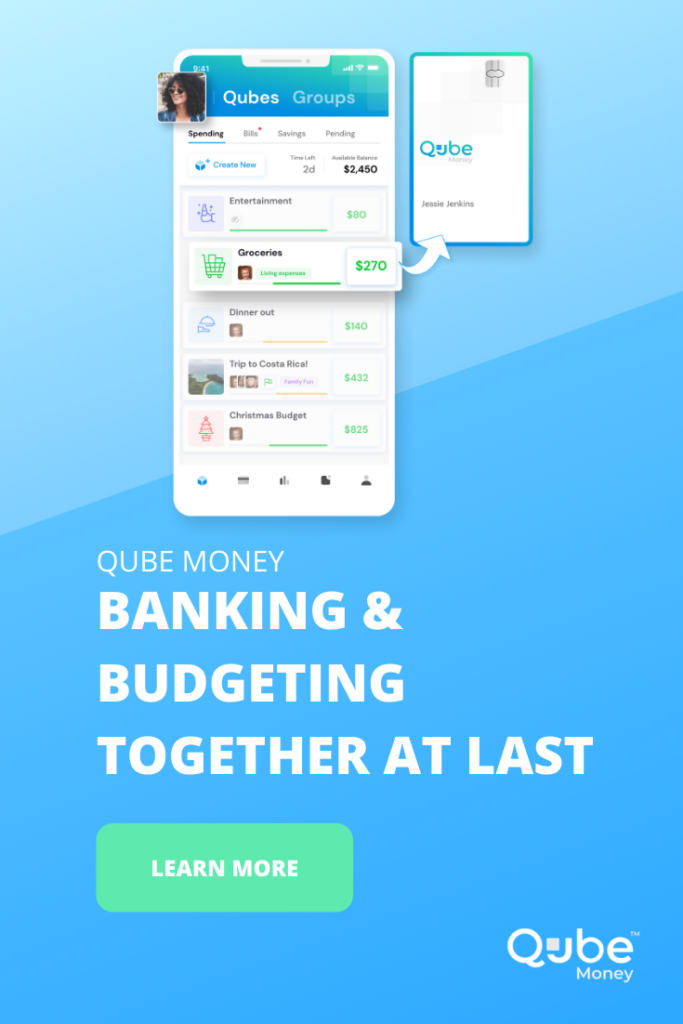

Qube Money replaces crusty paper envelopes with modern technology delivered via a mobile app and a plastic card you’ll use to spend. The system acts more like a banking system than a typical budgeting app.

In Qube Money, you will create “qubes” that function precisely the way cash envelopes do. Each qube will represent a spending category. You determine how much money will be loaded into each qube. To spend, you’ll use the app to open a qube manually, or your Qube Card won’t work.

By forcing you to open the qube in the app before spending, Qube forces you to reflect and evaluate your priorities before spending quickly. In a sense, the bank is the budget and vice versa!

With Qube Money, each dollar has a purpose and goal. You are in total control of your money and your spending.

Qubes aren’t only for spending either. You can use them to save for future goals (vacations, cars, special occasions, etc.). This means all of your daily money-management takes place in a single place. No more logging in and out of accounts to check balances.

Qube Money is Perfect For Couples

Some people will review their bank statements daily to track every penny they spend. Thankfully, most people choose to spend their time doing more important things. For couples, this means that monitoring what you are spending is difficult.

Qube Money makes this process more straightforward than ever by allowing families to share an account where all of the information is centralized. They even allow you to manage your subscriptions, which makes it super easy to see if you have overlapping subscriptions or are paying for things you no longer use.

Is privacy a concern? Look, I get it. Not all money in all relationships is meant to be spent by everyone or shared freely. Every relationship is unique. That’s why you can choose which Qubes are private and which can be viewed by other family members. Private qubes are a feature soon to be released.

If you are looking to your spouse as an accountability partner, you can also leverage Qube Money’s partner permissions, which means both partners need to approve purchases and transfers. Say bye-bye to the days of coming home with shopping bags full of impulse purchases.

More importantly, say hello to the days of finally hitting your financial goals! How’s that for a couples budget?

Built with Couples, Families, and Convenience in Mind

Any parent knows that convenience is critical. Your time is limited, and your to-do list is never-ending. Imagine yourself trying to use cash to pay for gas while you have two toddlers strapped into car seats in the back. Current Qube Money user Danielle Greany describes it perfectly, “Going to get gas, I can’t leave the kids in the car to use cash and come back out!”

With Qube, it’s as easy as tapping your gas Qube and swiping your Qube Card. The convenience of a card with the power of cash.

As your kids go from toddlers to adolescents and teenagers, one of the most important lessons you can teach them is how to manage their money effectively. Qube Money’s Kid Cards are the perfect tool to teach them these habits.

The days of handing your children cash are over. Now they can save toward their goals and make decisions the way you do. Create the Qubes together and set goals! These are the lessons they’ll carry with them forever.

Related: How to Teach Kids Money Based On Their Learning Style

Most budgeting apps are built with a single user in mind. Qube Money is different. We help couples budget better.

So remember, because you can chop an onion with a butter knife, it doesn’t mean you should.

We believe Qube Money will be the #1 tool to help couples budget better furthering our mission to decrease the divorce rate by 1%!

Also, check out how Qube Money helps families budget better!